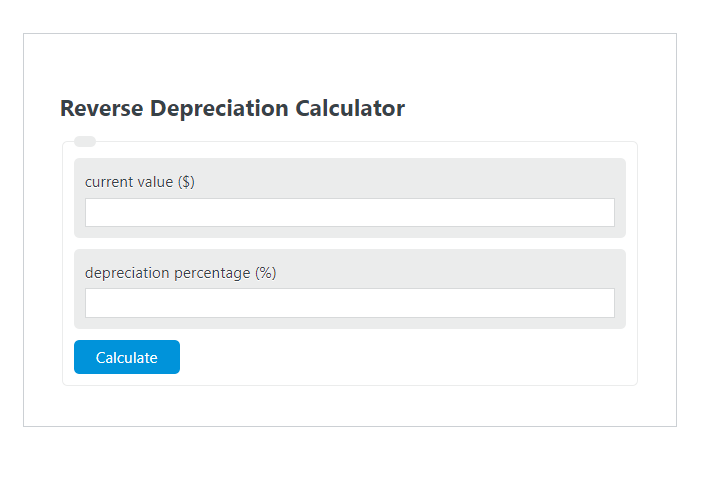

Reverse depreciation calculator

Step 1 Get the percentage of the original number. Supposing if you have data for three and four years check out what is the useful.

Service Tax Invoice Format Accounting Education Invoice Format Accounting Education Invoice Example

If the percentage is an increase then add it to 100 if it is a decrease then.

. Find the percentage of the original number in the example above the shirt in a sale marked 20 off costs 150 that is mean that 150 is 80 of the original shirt price 100 - 20. Importantly depreciation expenses are never reversed. In the Date of storno field select a date for the depreciation reversal.

This is because depreciation adjustments do not concern items covering two periods. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. Click Group operations Storno of depreciation to open the Storno of depreciation form.

Our car depreciation calculator uses the following values source. Uses mid month convention and straight. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

After two years your cars value. Finding the Reverse Percentage of a number in 3 easy steps. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Correcting an amount for a FA using Fixed Assets GL Journals after the Calculate Depreciation. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

After a year your cars value decreases to 81 of the initial value. Hello I noticed that if I make changes to an existing Fixed Asset eg. Calculate fixed asset depreciation Click Fixed assets Russia Journals FA journal.

Use this calculator to calculate an accelerated depreciation using the sum of years digits method. Check the document in AB03 and. Depreciation is taken as a fractional part of a sum of all the years.

Declining Balance Depreciation Calculator Choose declining rate calculate the depreciation for any chosen period and create a declining balance method depreciation schedule. Depreciation Amount Asset Value x Annual. Just input the original price of the property.

The only thing to remember about claiming. Total Depreciation - The total amount of depreciation based upon the difference. Use 0000 dep key to do rerun of depreciation for nullifying.

That much amount can be reversed I believe. Use the following procedures to calculate or reverse a fixed asset depreciation. Asset value 10000 useful life 5 years.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Follow the simple steps shown below to go on with the calculation. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Other example of adjustments that. Select the depreciation method whether its straight line or declining balance 200. Depreciation ac in f-02.

Credit the depreciation ac and debit the acc.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Pin On Infografiche Dal Web

Calculating Depreciation Youtube

Declining Balance Depreciation Calculator

Pin On Chart

Car Depreciation Calculator

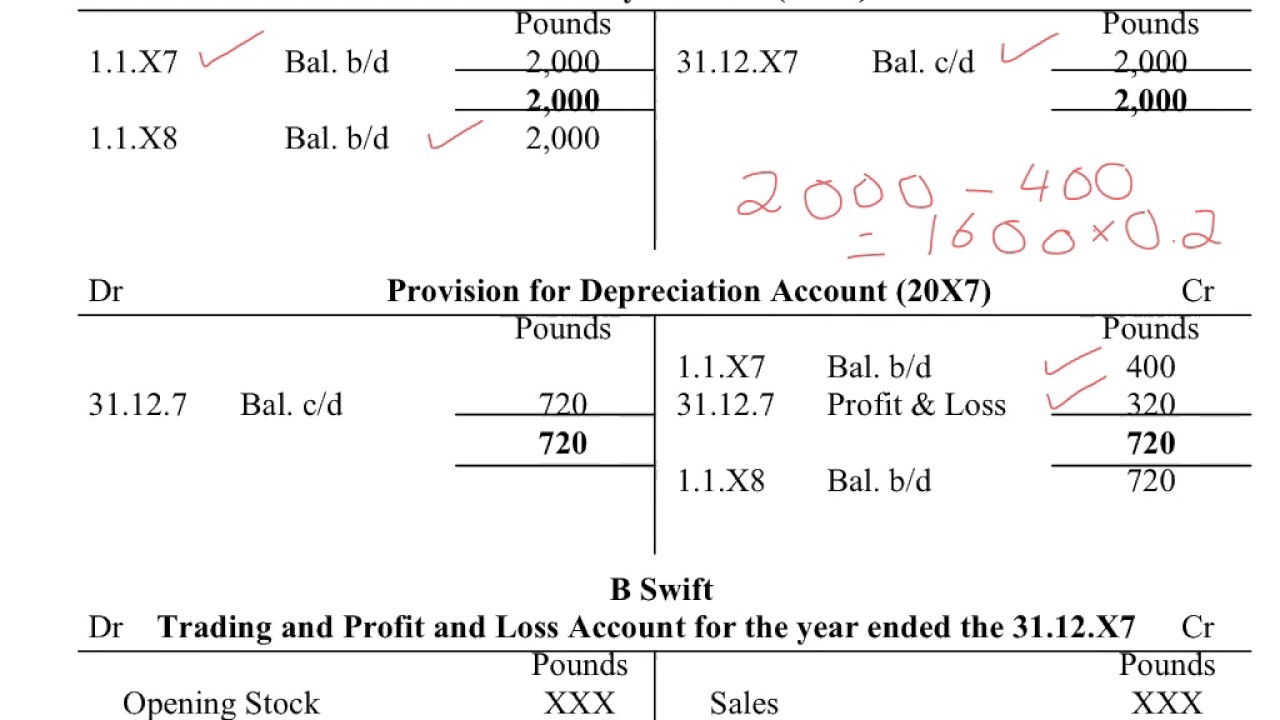

Igcse Accounts Understand How To Enter Depreciation Transactions Within The Double Entry System Youtube

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Reducing Balance Depreciation What Is Reducing Balance Depreciation

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

An Excel Approach To Calculate Depreciation Fm

Reverse Depreciation Calculator Calculator Academy

Napkin Finance Money Management Advice Finance Investing Accounting And Finance

Car Lease Vs Buy Calculator With Lifetime Cost Analysis Car Lease Money Life Hacks Saving Money

Depreciation Tax Shield Formula And Calculator Excel Template

Accumulated Depreciation Overview How It Works Example

Excel Salary Sheet With Formula By Learning Center In Urdu Hinidi Learning Centers Excel Learning